Protect yourself from recovery room scams

If you've lost money to a scam, you could then become the target of a recovery room scam. Also called follow-up fraud, these scams try to extract more money from you by pretending to recover the original lost funds.

Why it matters

If you have lost money to a scam and are looking for ways to get it back, you may be more likely to believe someone who offers to help you. Scammers may approach you pretending to be a recovery specialist, from the fraud team at your bank or even from the police. They may also have your details from a previous scam. All this makes them appear more credible and so it can be easy to fall for a recovery room scam.

If you’ve been affected by a recovery room scam, find out how to get help now.

The risks

Recovery room scammers will offer to help you recover your money in return for a fee. They may also ask you for your personal details or for access to your device.

- A common tactic scammers use is to offer you help with sending a ‘chargeback request’ to your bank, asking it to reverse a transaction you made to a scammer. These chargeback requests will not help you recover your money.

- Scammers may also try to obtain your personal information which can be used for online identity theft. Learn more about online identity theft and how to protect yourself from it. Protect yourself from online identity theft

- A scammer pretending to help you get your money back may ask for access to your device. If you allow them access, they can plant malware or ransomware on your computer. They may also look for accounts that you are logged into, such as online banking sites, to steal money or personal information. Protect yourself against malware

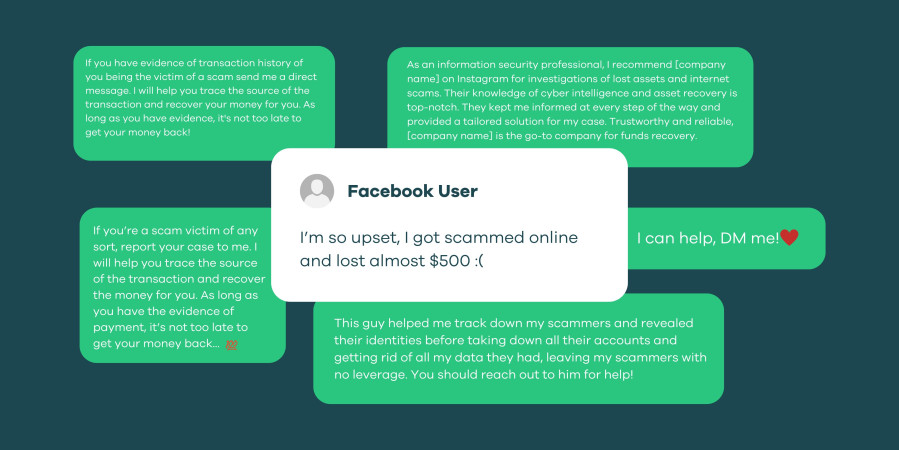

Read image description

[Victim] I’m so upset, I got scammed online and lost almost $500 :(

[Scammer] If you have evidence of transaction history of you being the victim of a scam send me a direct message. I will help you trace the source of the transaction and recover your money for you. As long as you have evidence, it's not too late to get your money back!

[Scammer] If you’re a scam victim of any sort, report your case to me. I will help you trace the source of the transaction and recover the money for you. As long as you have the evidence of payment, it’s not too late to get your money back... [100% emoji]

[Scammer] As an information security professional, I recommend [company name] on Instagram for investigations of lost assets and internet scams. Their knowledge of cyber intelligence and asset recovery is top-notch. They kept me informed at every step of the way and provided a tailored solution for my case. Trustworthy and reliable, [company name] is the go-to company for funds recovery.

[Scammer] I can help, DM me! [Heart emoji]

[Scammer] This guy helped me track down my scammers and revealed their identities before taking down all their accounts and getting rid of all my data they had, leaving my scammers with no leverage. You should reach out to him for help!

Protect yourself

-

Be cautious of who you're talking to

Be very suspicious of anyone other than your bank who claims they can recover your stolen funds. It’s hard to get your money back once it has been moved offshore.

Remember that scammers could pretend to be from your bank and call you. The best thing to do is to hang up and call back on the bank’s publicly listed number.

If someone calls you saying they are a government employee or from an organisation such as a bank, hang up and contact the organisation using their publicly listed contact details. If someone sends you an email, check the domain (the part of the email address after the @) matches that of the organisation they claim to be from.

-

Consider changing your contact details

If you have lost money to a scam, consider getting a new phone number and email address. It is likely your contact details will be on a scam list and changing your contact details is the only way to avoid being approached by fraudsters who have this list.

-

Do your research

If the ‘recovery’ company claims to be registered in New Zealand, you can look it up on the Companies Register.

New Zealand Companies Register(external link)

You can also look for a physical address or call the phone number listed on its website to check it’s a legitimate business.

-

Watch out for remote access software

If you have given anyone remote access to your device and you now suspect it is a scam, disconnect it from the internet, to prevent further access, until you are sure your device is secure again.

Get help now

Do not send money to anyone who claims they can help you recover funds. You may not be able to recover the initial funds or the fees you paid for help with recovering the initial amount.

If you think you are being targeted in a recovery room scam or know someone who is, you can report to the NCSC using our reporting tool.

Report to the NCSC(external link)

You can get more information on what to do if you have been caught in an online scam.